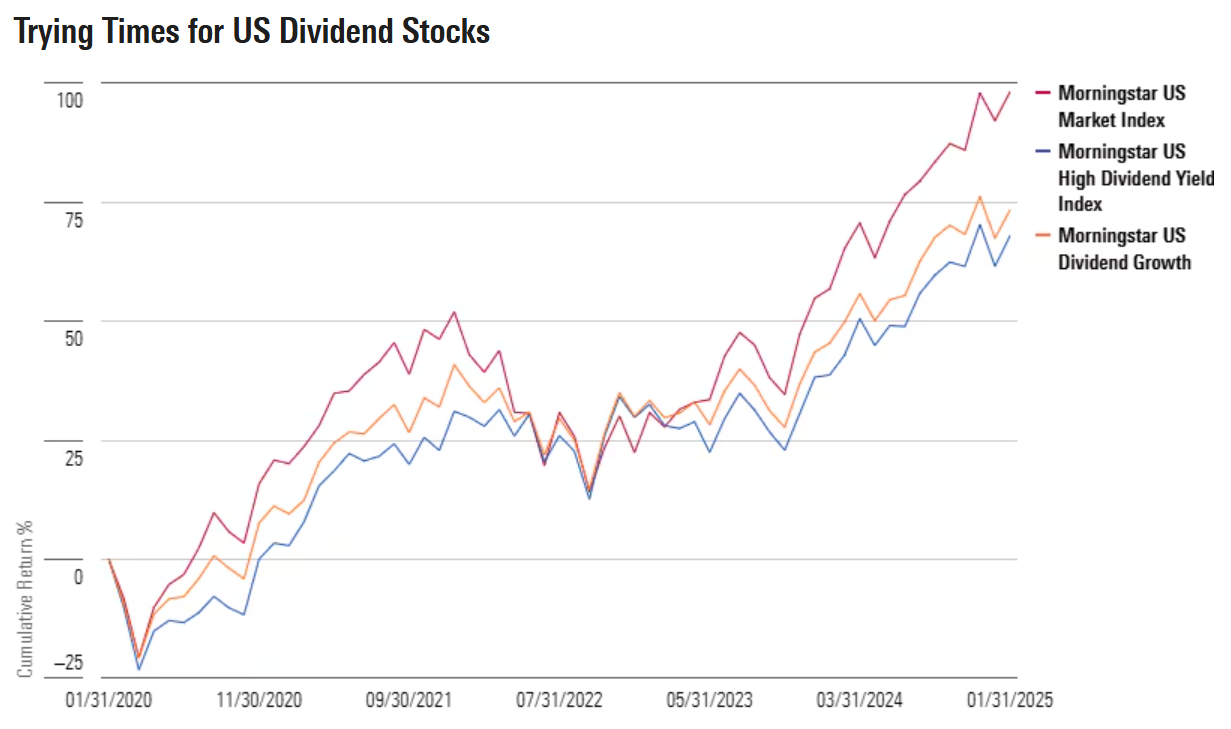

Back in December, I wrote an article called “Does Dividend Investing Still Work?” It was prompted by the failure of dividend stocks to keep up with the returns of the broad US equity market in 2024 and stretching back years now. My colleague Bella Albrecht also examined the topic in “Why Have Dividend Strategies Been Underperforming?” Dividend growth stocks have done better than the high-yielding section of the equity market over the past five years. But for the legions of equity income investors who own US dividend stocks directly or through mutual funds and exchange-traded funds, these have been trying times, at least on a relative basis, as displayed below.

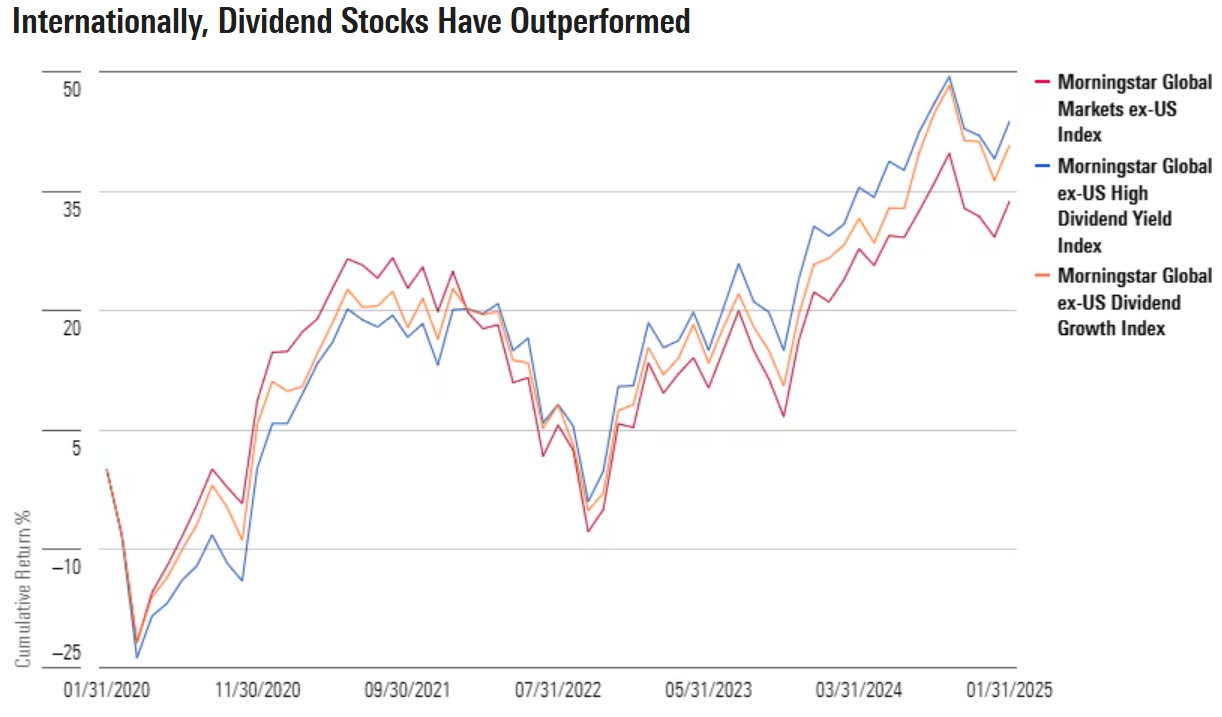

Our analyses were limited to the US, however. The story has been different for dividend stocks outside the US. Both the Morningstar Global Markets ex-US High Dividend Yield Index and the Morningstar Global ex-US Dividend Growth Index have outperformed the broad market for developed- and emerging-markets stocks outside the US. Whereas their US counterparts have failed to keep up, the international dividend benchmarks have been on top for the past five years.

I thought it’d be useful to examine why dividend stocks outside the US have outperformed while their US counterparts have lagged. What’s similar and what’s different about dividend investing across borders? And does the performance divergence hold lessons for the future?

Dividend Stocks Are Thriving Overseas – Relatively Speaking

The Morningstar Global Markets ex-US High Dividend Yield Index and the Morningstar Global ex-US Dividend Growth Index have both enjoyed strong runs. The higher-yielding half of the dividend-paying universe for developed- and emerging-markets equities outside the US, as well as the shares of companies consistently growing their cash payouts, are comfortably ahead of the broad market over the past five years, as displayed below.

What accounts for the performance divergence between US and international dividend stocks? For one thing, notice in the exhibit above that equity market returns have been much more subdued outside the US. The broad US equity market has returned nearly 100% on a cumulative basis over the past five years, while stocks outside the US are up less than 50%. Over the past five years, there has been only one down year for equities: 2022.

Dividend-payers tend to be more mature companies, stable enough to have cash to return to shareholders. In the US, dividend stocks have looked sluggish compared with a turbocharged market, while they’ve thrived on a relative basis in the lower-return environment outside the US. In the down year of 2022, dividend indexes in both the US and outside the US lost far less than the broad equity market. But in the big up years in the US, like 2021, 2023, and 2024, it was growth-oriented businesses, as opposed to stodgier dividend-payers, that led the charge.

Why Is Dividend Stock Performance Different Across Borders?

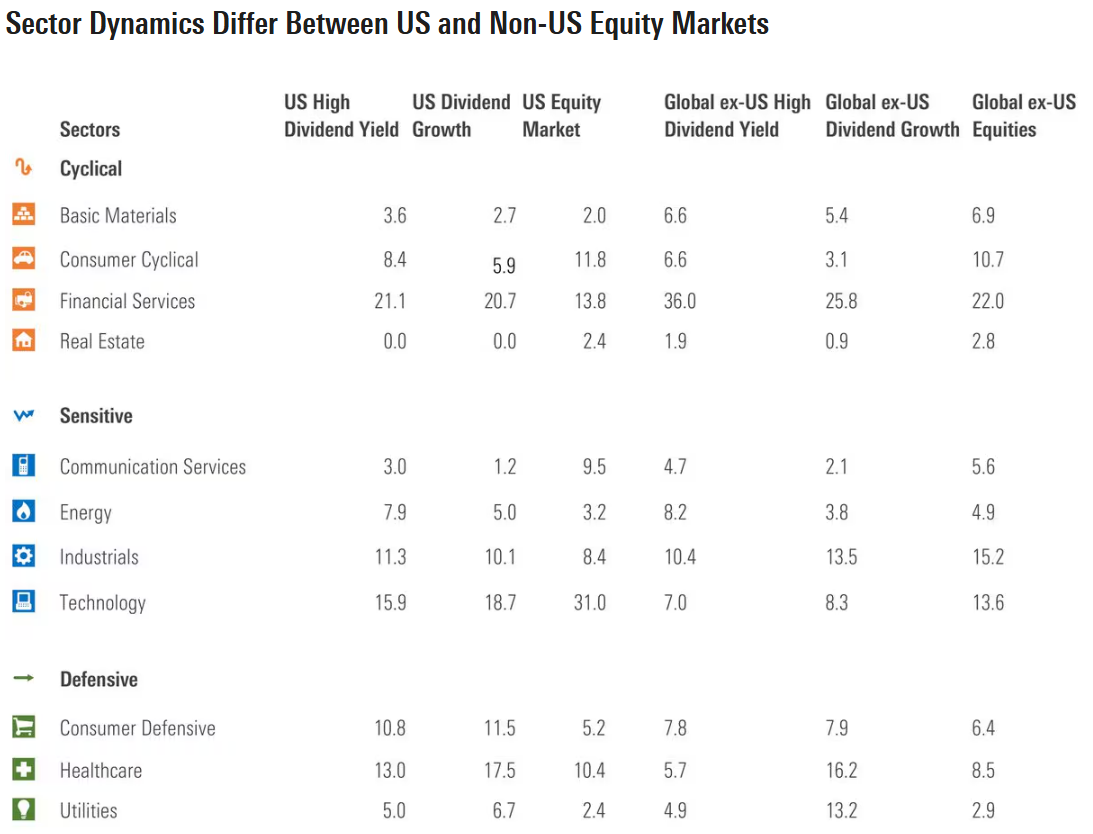

Sectoral dynamics are a big part of the performance difference between US dividend stocks and non-US dividend stocks. As we all know, the US stock market has been dominated by technology-oriented stocks—the “Magnificent Seven” and beyond. Technology trends accelerated during the pandemic, when life went digital, and artificial intelligence has been the dominant investment theme since late 2022. The recent leadership of the US equity market has not exactly been dividend-rich. Nvidia NVDA pays a dividend, but it doesn’t meet the criteria for either the Morningstar US High Dividend Yield Index or the Morningstar US Dividend Growth Index. Neither do Alphabet GOOGL and Meta Platforms META, which only began paying dividends in 2024. Amazon.com AMZN and Tesla TSLA do not return cash to shareholders in the form of dividends. Apple AAPL and Microsoft MSFT are in the dividend growth index, while Broadcom AVGO is in both dividend indexes. But it hasn’t been enough. Technology stocks represented 32% of US equity market value coming into 2025 but just 16% of the US high-dividend yield index and 19% for dividend growth, as displayed below. That has been a big handicap to overcome.

When it comes to stocks outside the US, technology is not nearly as big a chunk of the market. Yes, there’s Taiwan Semiconductor Manufacturing TSM, SAP SAP, ASML ASML, and Samsung Electronics 005930, but the technology sector overall accounts for just 14% of the broad market, while the dividend indexes devote 7%-8% of their weight to the sector, as displayed below. Tech is not the return driver it is in the US. (In case you’re wondering, both TSMC and Samsung are members of the high-dividend index, while SAP is in dividend growth).

Financial services, however, is a big slice of the universe for stocks outside the US, and also an overweight exposure for both international dividend indexes. The sector has been a strong performer lately—in many markets. In Europe, for example, financial services can claim to be the best performer for the past three years, as higher interest rates increased net interest margins for banks. Japanese, Canadian, and Australian banks, as well as insurers like Allianz ALV and AXA AXA, have also contributed to dividend index outperformance.

The Outlook for Dividend Stock Investors

Over the very long term, dividend stocks have outperformed in markets across the globe. Why? Several reasons have been proposed, from the weeding out of speculative companies, to the discipline the dividend commitment instills in corporate managers, to dividend-payers benefiting from the “value effect”—the phenomenon of stocks with lower valuations having outperformed.

A strong long-term track record does not mean dividend stocks will beat the market in the future, however. Dynamics have changed. Share buybacks have become a more popular way for companies to return cash to shareholders in the US and globally.

But to me, equity income investing—through a diversified basket of high-yielders or dividend-growers—is a perfectly reasonable way to participate in equity markets. The fact that assets in dividend strategies have held steady over the many years that the approach has been out of favor in the US shows that dividend investors are patient and willing to stomach some underperformance.

Of course, the risks of dividend stocks must be acknowledged. Investors must accept lagging periods—like recent years in the US—just as any deviation from the market comes with inevitable cyclicality. It’s also critical not to fall into “dividend traps.” The market’s highest yields are often located in troubled companies and industries, where payouts are untenable. So, screening for dividend durability, or diversifying across a huge basket, is sensible.

Risk-aware equity income investors can take heart in the relative performance of international dividend stocks in recent years. Their success demonstrates that a change in market dynamics could make equity-income investing more successful in the US. In a more subdued return environment or if the dividend-light technology sector abdicates market leadership, the performance picture for dividend stocks could look very different.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.