As originally published on Morningstar.com.

There are more than 50,000 sustainability indexes. They’ve played an important role in the growth of sustainable investing, representing strategies ranging from ESG to climate to impact, according to a 2022 Index Industry Association survey. The indexes cover a range of asset classes, countries and regions, size segments, factors, and themes. Climate-investing indexes alone encompass ex-fossil fuel, low carbon, climate transition, and investment themes like green bonds, renewable energy, clean technology, and climate solutions.

Since environmental, social, and governance investing turns 20 years old this year, it’s worth looking at where ESG indexes come from—and the origin story of the first ESG index.

The First ESG Index

The early history of sustainable investing was shaped by entrepreneurs. In the early days of sustainable investing, there were no established standards and practices. Yet the early ESG index entrepreneurs forged ahead, developing tools and products to address a vision of aligning portfolios with investor values and their views about sustainability.

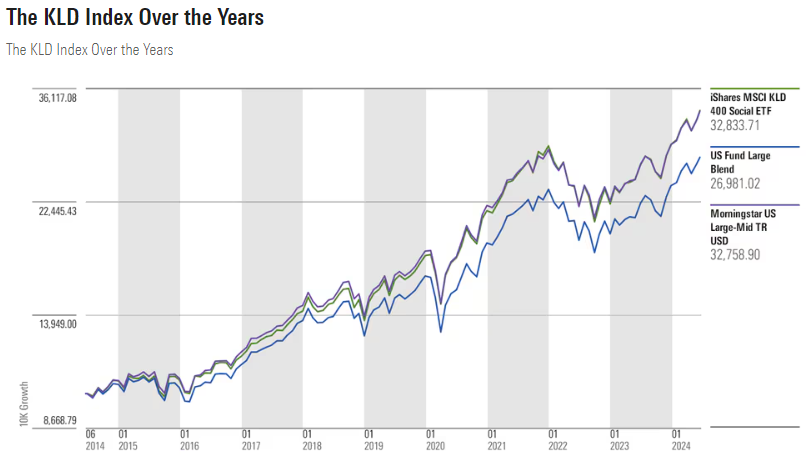

A prominent example is the Domini 400 Social Index (Domini 400), launched in May 1990. With a track record of over 34 years, it is the first ESG index and has the longest continuous performance history. It has served as the basis of investable products since June 1991 and is the benchmark for the popular and widely followed iShares MSCI KLD 400 Social ETF DSI.

What is so special about this index that it has withstood the test of time? The story behind the Domini 400 is instructive for understanding the development of sustainable investments and the crucial role of indexes in the evolution of new investment practices. The index was originally the brainchild of Peter Kinder, Steve Lydenberg, and Amy Domini, founders of Kinder, Lydenberg, Domini & Co. of one of the first socially responsible investing research firms. Based on its long track record and consistent methodology, the Domini 400 Index is widely cited in academic and practitioner literature analyzing the financial performance of ESG investments.

Every index has a purpose and an investment thesis. KLD created the Domini 400 to provide data to identify coverage of companies that meet ethical and ESG standards and provide data on the risk and return characteristics of SRI. KLD’s founders believed that companies exhibiting strong ESG credentials could also manage risk and perform well over the long run. This perspective challenged the prevailing view that limiting one’s investment universe would be a drag on performance. (After becoming the first managing director of indexes at KLD in the early 2000s, I had the opportunity to observe the workings of the Domini 400 committee and then shepherd the index through some of its later incarnations, from 2001 to 2017.)

A Flexible Floor Plan

Like an old house that adapts and changes to stay relevant in a more modern world, the Domini 400′s methodology evolved over time, paralleling the evolution of sustainable investing. KLD initially constructed the Domini 400 by applying product-based exclusions (alcohol, tobacco, gambling, military weapons, and nuclear power) and then selecting companies whose records on community, employee relations, environment, product quality and safety, and women and minorities (later called diversity) stood out from their peers. The process started with constituents of the S&P 500, then considered to be the best benchmark for the US equity market. Aiming for similar sector diversification, the committee selected about half its constituents, added about 100 mid-cap companies that stood out in their industries, and about 50 small caps with exemplary records, for a total of 400. Like with the S&P 500, constituent decisions were made by a dedicated committee based on written guidelines.

In the absence of accepted standards and systematic research on ESG issues, KLD developed its own analytical framework and conducted its own research. This was a herculean task in the predigital world where pertinent information was scarce, particularly around ESG. Companies did not routinely disclose relevant data, were reticent to respond to questionnaires, and rarely returned phone calls. KLD scoured newspapers, periodicals, journals, and government databases, and it sought information from nonprofits about companies and issues.

The internet was a boon to ESG research as information became more abundant and accessible. Companies began publishing sustainability reports, and corporate stakeholders gained a platform to advocate for more sustainable business practices. The combination of Big Data and quantum computing power greatly expanded the range of data used in ESG ratings. It also contributed to greater corporate transparency, giving shareholders more material information on ESG issues for making investment decisions. Today, 96% of S&P 500 companies publish sustainability reports, up from 20% in 2011.

The Domini 400 went through several name changes during its first two decades, reflecting the transition of ESG investing from niche to mainstream: KLD 400 Social Index, FTSE KLD 400 Social Index, and MSCI KLD 400 Social Index. Its methodology also changed in response to advances in ESG research, best practices in index management, and the evolving preferences of ESG investors. The framework added analysis of corporate governance and human rights, as well as screens for civilian firearms, thermal coal, and other topics. Today the index is entirely rules-based, uses ESG ratings (which did not exist in the 1990s) and controversy scores, and has greater emphasis on climate-related issues.

The Important Role of ESG Indexes

Stock market indexes may appear to be dry, technical financial tools. But they play an integral role in capital markets as scorekeepers, facilitators, and validators. As scorekeepers, they provide a stream of objective data on risk, return, financial fundamentals, and other factors. As facilitators, they are tools for passive investments and performance benchmarks for actively managed strategies. As validators, they test the financial efficacy of the data used in their construction.

Similarly, ESG indexes provide transparent, rules-based, and cost-efficient exposure to ESG, climate, and impact factors. Their rules codify new approaches to investment. They function like the broad market capitalization-weighted indexes that most investors are familiar with, noting that their credibility is primarily determined by the quality of the underlying sustainability data and the index methodology. So, investors should verify that their ESG benchmark comes from a trustworthy index provider and the sustainability data inputs come from a reputable source.

Scorekeepers. In addition to their function as performance benchmarks, ESG indexes enable investors to measure sustainability characteristics related to ESG, climate, and impact of different investment approaches. For example, with the growing interest in climate investing, investors can now measure the carbon intensity of their investments and compare it with that of a climate transition fund and a broad market beta fund. So, sustainability indexes are benchmarks for measuring both financial and sustainability standards.

Facilitators. Passive funds based on ESG indexes represent approximately 30% of the $3 trillion total assets in global sustainable funds with 39% of US sustainable assets in passive funds, according to a recent Morningstar report. Investors are attracted by the transparency and low cost, in line with global trends favoring passive investments.

Validators. By providing information on how well sustainability data achieves its objectives, indexes are a proving ground for this sustainability data. Perhaps the most important contribution the Domini 400 story illustrates is how the disciplined and systematic data requirements of indexes contributed to the advance of ESG research. KLD created company-level ESG scores—precursors to ESG ratings—to support its growing index business. Today, the use of ESG research in portfolio management has benefited from the strict quality standards that indexes require.

ESG Indexes Today

Politicians criticizing ESG investing claim that it violates fiduciary duty, challenging evidence that ESG strategies can generate risk-adjusted returns that match or exceed the market. By providing unbiased financial and sustainability data, ESG indexes will be instrumental in adjudicating this dispute. While the founders of KLD may not have anticipated the growth trajectory and popularity of sustainable investing, the essential purpose of the Domini 400 Index set the stage for a new class of financial benchmarks that have had―and will continue to have—a profound impact on the investment landscape.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.