In retrospect, maybe we should have expected stocks to hit the skids in 2025. The Morningstar US Market Index came into the year hot, having advanced roughly 50% across 2023 and 2024. After a postelection rally, stocks looked “priced to perfection” in the words of my colleague, Morningstar Chief US Market Strategist Dave Sekera.

To say there’s been a market “reset” in 2025 is a massive understatement. As I wrote about last week, uncertainty around Trump tariff policy has roiled asset prices, with three daily swings of more than 5% for stocks in April alone, not to mention all the drama we’ve seen in the Treasury bond market. Stocks are down roughly 12% in aggregate from the start of the year through April 21, and some of the market’s biggest stars coming into 2025—names like Nvidia NVDA, Apple AAPL, and Broadcom AVGO—have shed more than 20%.

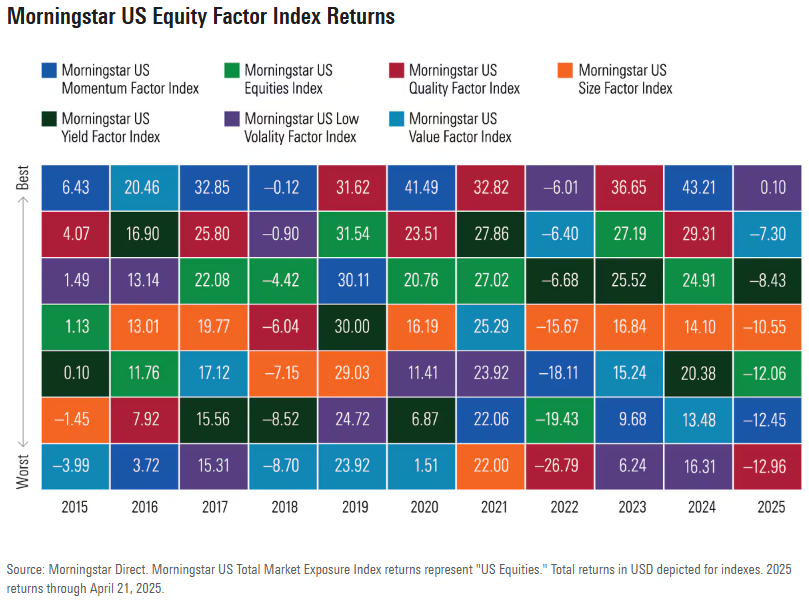

Yet, one grouping of US stocks is somehow in positive territory this year. The Morningstar US Low Volatility Factor Index has held its value, while other benchmarks tracking common stock characteristics are deep in the red. Judging from a “Periodic Table” of returns for Morningstar US Factor Indexes*, low-volatility stocks also showed resilience in the “risk off” markets of 2022 and 2018.

I’ve used factors before to analyze the market. I find our indexes representing different sources of return handy lenses through which to view divergence in investment behavior. Factor performance in 2025 offers insight into what works well when. It also serves as a reminder about the important role diversification plays in controlling for the unexpected.

Ideal Conditions for the Low-Volatility Factor

Limiting losses is key to the long-term success of the “low-volatility factor,” which isn’t necessarily about beating the market, but more about producing superior risk-adjusted returns. Why does the factor work? According to academic research going back decades, volatile stocks become overbought. They attract both professional investors desperate to beat their benchmarks and individuals chasing their potential.

This positions less-volatile stocks to surprise on the upside. When equities sell off, low-volatility stocks tend not to be punished as badly. Capital preservation in down markets is a path to superior long-term returns, especially when you adjust for risk. In the immortal words of Warren Buffett: “The first rule of an investment is don’t lose [money]. And the second rule of an investment is don’t forget the first rule.”

Speaking of Buffett, Berkshire Hathaway BRK.A BRK.B is the second-largest current constituent of the Morningstar US Low Volatility Factor Index and has been key to its relative success in 2025, as displayed below. My colleague John Rekenthaler has even used Berkshire as a totem of the risk-off market, where investors are fleeing to assets perceived as relatively safe. Johnson & Johnson JNJ and Coca-Cola KO are other low-volatility index constituents that have held up relatively well this year.

How did these constituents get selected? The low-volatility factor index picks stocks based on price activity over the previous six months. It doesn’t just consider total volatility but also looks at five-day stretches to favor companies that haven’t seen big moves. Constituents are weighted by market capitalization.

Looking back over history, low-volatility stocks display a clear pattern of behavior. Not only did the Morningstar US Low Volatility Factor Index lose less than the market in down years like 2022 and 2018, it held up in the “Pandemic Panic” of 2020’s first quarter. And it thrived in 2024’s third quarter, when investors got jittery.

On the flip side, you’ll see low-volatility stocks lagging in big up years. For example, in 2023-24, light exposure to the “Magnificent Seven” (Alphabet GOOGL, Amazon.com AMZN, Apple, Meta Platforms META, Microsoft MSFT, Nvidia, and Tesla TSLA) held the low-volatility index back, while healthcare stocks like Johnson & Johnson and Abbott Laboratories ABT were poor relative performers.

Variability Is a Fact of Life for Factors

Low volatility isn’t the only factor that has gone from zero to hero in 2025, at least in relative terms. Value, yield, and size have all lost less than the market so far in 2025 after having lagged in 2023 and 2024. Note that while size tilts toward smaller stocks, the actual small-cap segment of the US stock market has underperformed in 2025, as I discussed here.

At the other end of the spectrum are quality and momentum. The Morningstar US Quality Factor Index and the Morningstar US Momentum Factor Index are the only members of the suite to have produced superior returns to the broad equity market for the 10 years through 2024. These same two factors have underperformed in 2025. “Quality” stocks are highly profitable companies with strong balance sheets. Most of the Magnificent Seven fit the bill, which goes a long way toward explaining the factor’s outperformance. Momentum has won in recent years largely by riding the quality wave. When market direction changes, the momentum factor gets tripped up.

Only time will tell if the factor rotation we’ve seen in 2025 will persist. The third quarter of 2024 also saw a changing of the guard, only for the market to revert to long-running trends. That said, different factors thrive in different conditions. Value and size were dominant in the first decade of the 2000s, for example.

What This Means for Investors

A critical takeaway from the Periodic Table is that factor leadership is dynamic. “No pain, no premium” speaks to the performance cyclicality at the core of factors’ promise. They are only effective over the long term.

Investors lacking the intestinal fortitude to endure underperformance could diversify by factor. This strategy is reflected in the Morningstar US Multifactor Index, which has lost less than the broad equity market this year. A tilt toward value stocks has helped the multifactor index in 2025—specifically a large weight in Berkshire Hathaway.

There’s also nothing wrong with avoiding factors altogether and just owning the broad equity market. That strategy has been a winner in recent years. More-muted returns and trickier conditions, however, could lead to a revival in factor investing.

*Morningstar Factor Indexes were launched in January 2023 with returns backcast to 2008 based on a methodology derived from the Morningstar Risk Model.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.