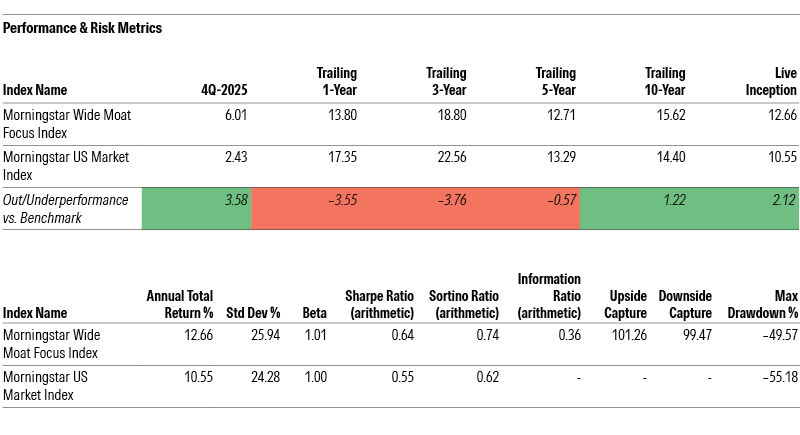

The Morningstar Wide Moat Focus Index represents a basket of undervalued US stocks with wide economic moat ratings, as determined by Morningstar equity analysts. The index methodology typically leads to notable overweight and underweight positions as it pertains to sector and themes. Over the last couple years, being underweight the “AI theme” has weighed heavily on relative performance. However, in the fourth quarter, the incredible momentum of “AI stocks” took a pause, enabling the Morningstar Wide Moat Focus Index to generate a 6% total return, +358 basis points ahead of its benchmark, the Morningstar US Market Index.

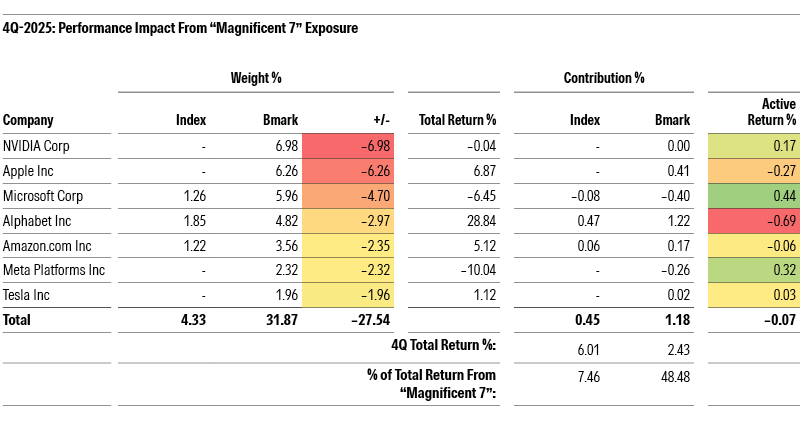

The index benefitted from favorable sector positioning as well as favorable stock selection within sectors. Interestingly, despite performance of the “Magnificent 7” stocks (Nvidia, Alphabet, Apple, Microsoft, Amazon, Meta Platforms, and Tesla) as a group having slowed in the fourth quarter, the Magnificent 7 still accounted for nearly 50% of the Morningstar US Market Index’s 2.4% total return. As a result, the Morningstar Wide Moat Focus Index’s equal-weighting scheme, which drives a significant underweight in the Magnificent 7, remained a headwind and had an unfavorable impact on excess returns.

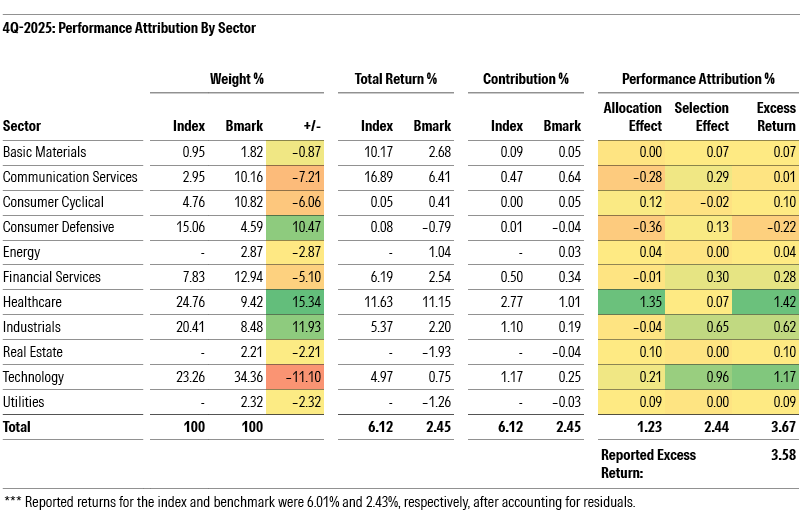

Looking across sectors, Technology remains in focus, given its significant 34% weighting in the Morningstar US Market Index benchmark in the fourth quarter. The Morningstar Wide Moat Focus Index remained underweight at only a 23% weighting, with this underweight position driving a modest performance benefit. Stock selection within the sector was more impressive, boosting excess returns by nearly +100 basis points.

With some leading AI stocks having pulled back in the fourth quarter, the index’s December reconstitution saw the addition of Nvidia, Meta Platforms, and Oracle to the Morningstar Wide Moat Focus Index. We also believe that AI-related concerns surrounding the software industry are overdone, with ServiceNow also having been added while the index increased positions in Microsoft and Tyler Technologies.

Consistent with its positioning over the course of the full-year, the Morningstar Wide Moat Focus Index maintained three notable sector overweights in the fourth quarter -- Healthcare, Industrials, and Consumer Defensive.

The Healthcare sector continues to carry the highest overall weighting in the Morningstar Wide Moat Focus Index at 25%, which paid off in the fourth quarter as Healthcare was the best performing sector in the benchmark. The index’s overweight position in Healthcare drove +135 basis points of outperformance. We see some upside opportunities in biopharma stocks such as Bristol-Myers Squibb, Merck, and Amgen as we continue to believe that concerns about drug pricing reform are significantly overblown. Additionally, for a variety of idiosyncratic reasons, the index is overweight medical devices companies like GE Healthcare Technologies, Zimmer Biomet Holdings, Thermo Fisher Scientific, and West Pharmaceutical Services.

The Morningstar Wide Moat Focus Index’s exposure to Industrials, 20.4% versus 8.5% for the benchmark, had little impact on excess returns as the sector’s performance was roughly in line with the broader market. However, stock selection within the sector was favorable, adding +65 basis points of outperformance. Caterpillar is a high-profile holding that fared well, thanks to its increasing AI exposure as part of data center buildouts. Masco remains one of our top picks, as we believe that the performance of housing-related stocks will transcend the negative investor sentiment that has been plaguing them. Additionally, we see upside for certain defense companies like Huntington Ingalls Industries, Northrop Grumman, and Boeing as demand for their specialized products remains robust amid heightened geopolitical tensions.

In Consumer Defensive, the index had a 15.1% weighting versus 4.6% in the benchmark. This positioning weighed modestly on relative performance, as the sector underperformed the broad market. Here, we’ve observed concerns that the US “affordability crisis” may weigh on branded products that command a higher price point than generic competitors. However, leading CPG firms and retailers have many tactics to combat this dynamic. Specifically, innovation from R&D spending along with tactical marketing campaigns should help stem the tide of modestly rising US private label market share. Over the long run, these strategies should benefit current holdings like Mondelez International, Clorox, Hershey, and PepsiCo.

©2026 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.