The Takeaway

In the second quarter of 2025, the Federal Reserve maintained a cautious approach by keeping the target federal-fund rate unchanged.

The US Personal Consumption Expenditures Price Index indicated inflation was still above the 2% target set by the Fed.

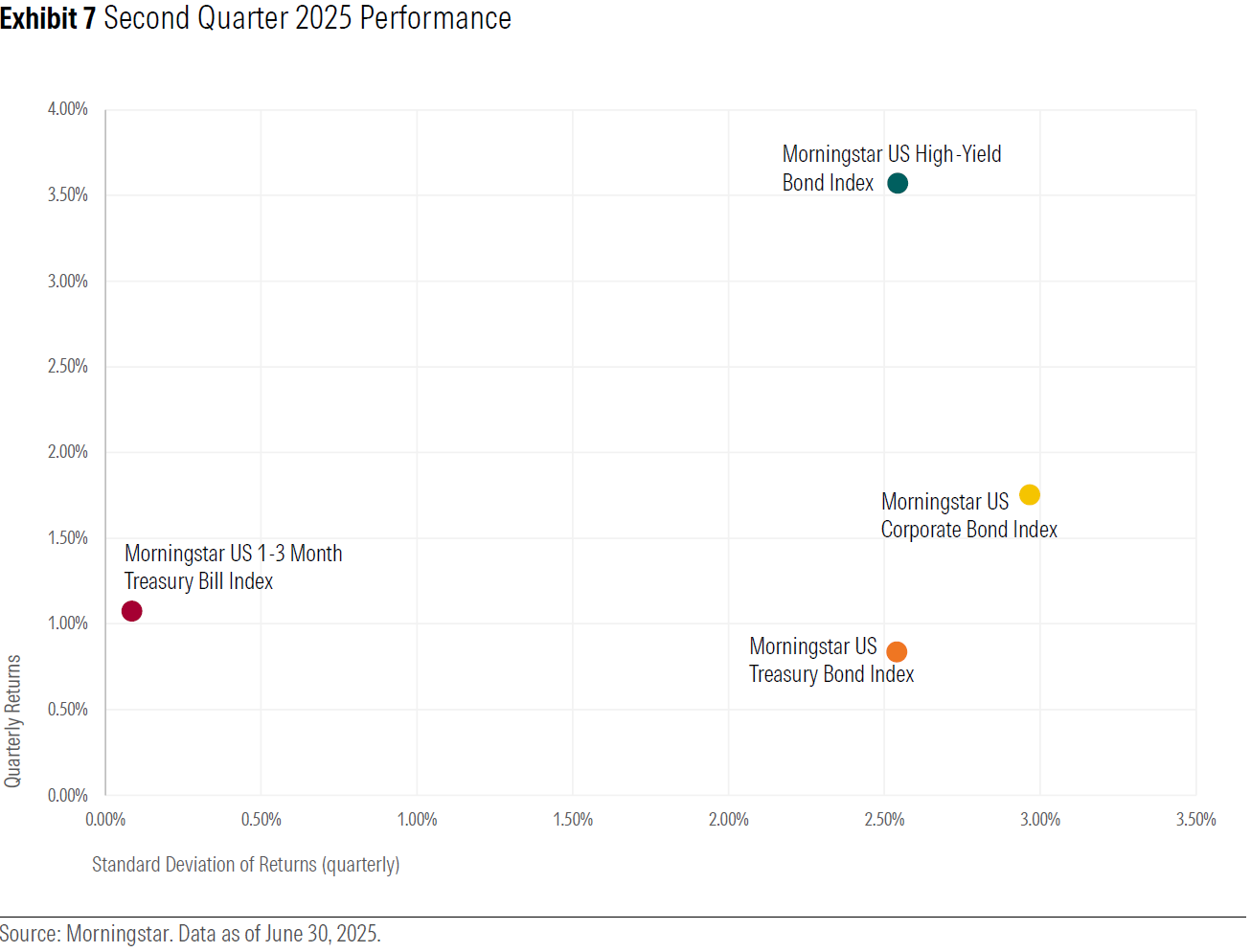

The Morningstar US High Yield Bond Index provided the best risk/return characteristics over the second quarter of 2025. This was followed by the Morningstar US Corporate Bond Index. The Morningstar US Treasury Bond Index and the Morningstar US 1-3 Month Treasury Bill Index experienced muted returns over the second quarter of 2025.

The Fed maintained the target federal-funds rate at 4.3% to 4.5% in both the May and June 2025 Federal Open Market Committee meetings. The first quarter of 2025 witnessed a 0.5% decline in real gross domestic product as compared with a 2.4% growth in the fourth quarter of 2024. This marks the first decline in real GDP in three years. The second quarter of 2025 saw no significant movement in short-term rates. Treasury rates up to one year rose 5 basis points on average. Longer maturity term rates beyond 10 years saw an increase of 15-20 basis points. The medium tenure term rates between two to seven years saw a decline of 15 basis points on average. The second quarter of 2025 has seen riskier assets outperform. The Morningstar US High Yield Bond Index led performance followed by the Morningstar US Corporate Bond Index. The Morningstar US Treasury Bond Index posted subdued returns in the second quarter of 2025, reflecting investor willingness to gravitate towards riskier assets in search of higher yields. Meanwhile, the Morningstar US 1-3 Month Treasury Bill Index remained flat, as short-term interest rates held steady throughout the quarter.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.