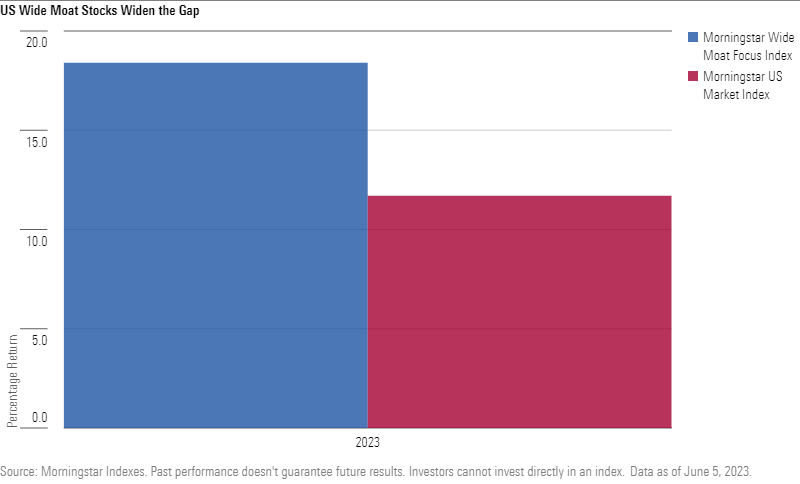

The Morningstar Wide Moat Focus Index has risen 18.4% in 2023 as of June 5, nearly 7 percentage points above an 11.7% return for the broadly diversified Morningstar US Market Index.

This index, currently consisting of 49 constituents, is designed to provide exposure to US stocks that Morningstar Equity Research believes have long-lasting competitive advantages, or “wide” economic moats, and are trading at an attractive price relative to fair value.

Year-to-date outperformance for the Morningstar Wide Moat Focus Index has been driven by both sector positioning and stock selection. So far this year, the index has been most overweight in the Industrials and Technology sectors and most underweight the Energy and Consumer Defensive sectors. Communications Services company Meta Platforms, owner of Facebook, has been the most significant contributor to 2023 outperformance.

Andrew Lane, Director of Equity Research, Index Strategies at Morningstar:

“Entering 2022, the Morningstar Wide Moat Focus Index exhibited a modest bias towards ‘value’ which helped support outperformance over the course of the year as the broad market traded lower. However, by year-end 2022, the index had migrated over to the modest growth bias we observe today. This rotation set the stage for the strong relative performance we’ve observed amid the 2023 market rally after the index’s performance had held up quite well in the down market of 2022.”

Ali Mogharabi, Senior Equity Analyst, Morningstar Research:

“The shares of wide-moat rated Meta have recovered significantly in 2023, up more than 125% as of June 5, and approaching our fair value estimate of $278. The firm's quarterly results have confirmed our views on Reels monetization, ad conversion improvement, margin potential, and an unharmed network effect moat source.”

Brandon Rakszawski, Director of Product Management, VanEck:

“Many investment approaches designed to reduce volatility and downside risk associated with the US equity market subsequently fall out of favor with investors due to their lack of participation in recoveries. The Morningstar Wide Moat Focus Index has a long track record of not only mitigating relative drawdowns, but also participating in recoveries. That is exactly what has played out for the index through the market turmoil of 2022 and recovery thus far in 2023.”

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Morningstar, Inc. is not affiliated with Van Eck. Van Eck's products are not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in any Van Eck product.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.