Morningstar Indexes’ most recent equity market analysis touches on the bad news as well as potential good news for US small-cap stocks.

The bad news: Despite conventional wisdom holding that small-cap stocks tend to rally in recoveries and lag heading into recessions, US small-caps have underperformed the broad equity market for the last 1-, 3-, 5-, 10-, 15- and 20-year periods, across a range of economic cycles.

The good news: Small caps look cheaper now relative to the broad market than at anytime in the last 20 years, and investors who take a selective approach to this asset class to weed out low-quality companies and consider valuation might find value for their investment portfolio.

In his new paper – Why Have Small Caps Lagged Amid Economic Growth and Recovery? – Morningstar Indexes’ Strategist Dan Lefkovitz examines the US small cap conundrum, determining that the small-cap segment has been disadvantaged by its exposure to sectors like real estate, financial services and consumer cyclicals, not reaping the full rewards from trends like digitization and artificial intelligence.

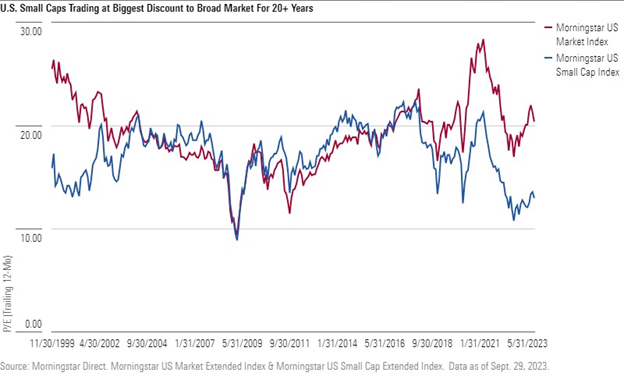

But small caps’ future could be brighter than their past. The gap between the Morningstar US Small Cap Extended Index and the broad equity market is at a level not seen for more than 20 years on a price/earnings basis, and Morningstar Equity Research sees small caps as the most attractive size segment on a forward-looking valuation basis.

Lefkovitz highlights the Morningstar US Small-Mid Cap Moat Focus Index, targeting small- and mid-cap stocks with durable competitive advantages and attractive valuations based on the forward-looking insights of Morningstar’s equity research team.

Dan Lefkovitz – Strategist, Morningstar Indexes:

“Small caps could continue to underperform, and the market's behemoths could dominate indefinitely. But the mere possibility of a leadership rotation should be enough for investors to consider an allocation to small caps. Valuation is a better justification for small-cap exposure than forecasts for economic growth or recovery.”

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.