The Takeaway

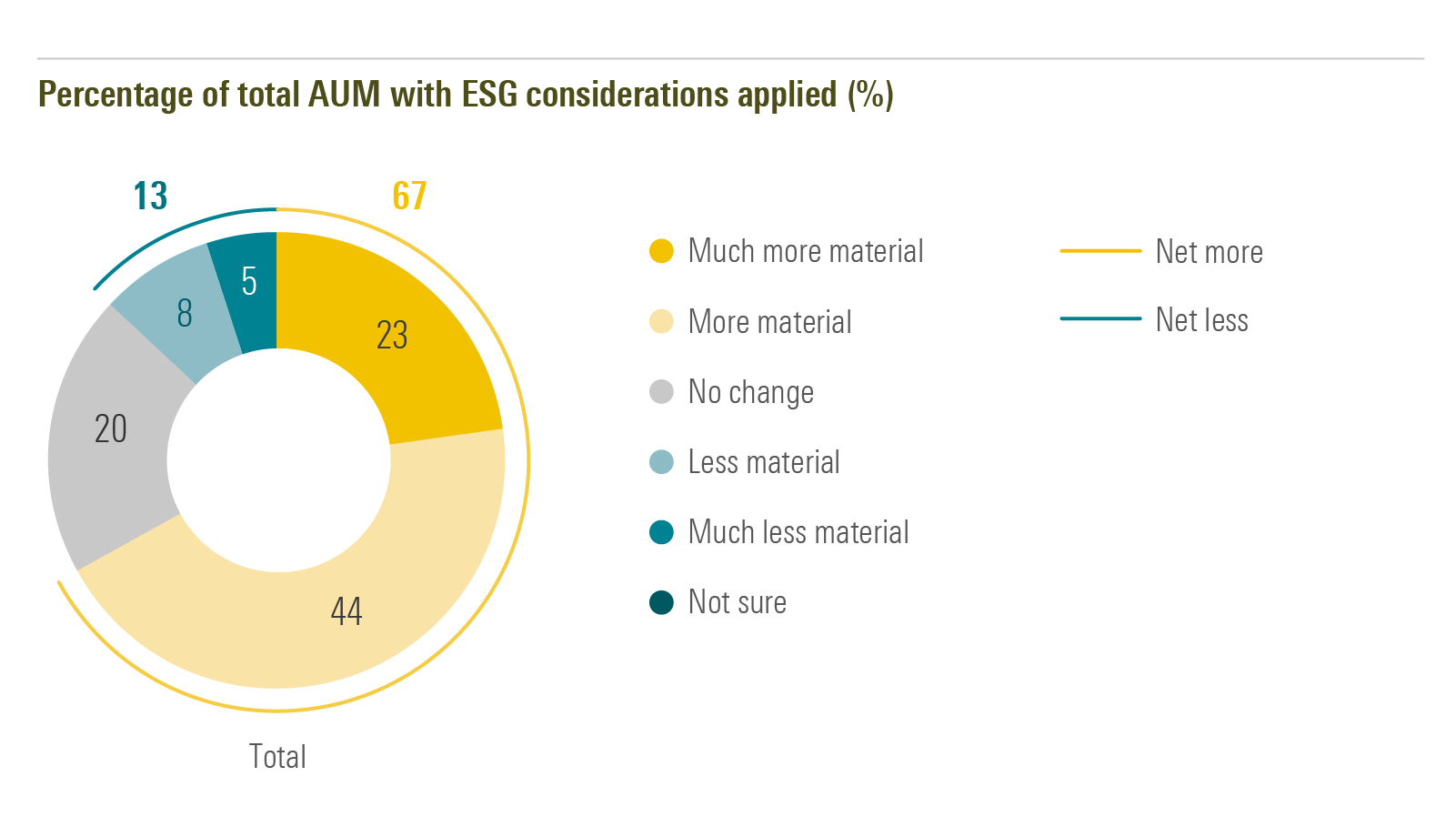

More than two thirds of asset owners (67%) globally believe that ESG has become more material to their investment process in the last five years, and every asset owner surveyed is allocating at least a portion of their assets to strategies that take ESG factors into account.

Climate transition readiness remains the most material environmental factor, with labor practices and business ethics headlining material concerns for social and governance, respectively.

Globally, the majority of asset owners surveyed (78%) view active ownership as useful in driving the implementation of their ESG program overall, with direct engagement ranked as the most impactful method of active ownership across all regions.

As stewards of large pools of capital and fiduciaries for their beneficiaries and stakeholders, asset owners provide valuable perspectives on global markets, investment policies, and standards. Due to their large asset bases and their ability to affect market dynamics, influence corporate practices, and set trends in investment strategy, asset owners’ actions and decisions wield significant influence over other types of investors.

To better understand the global asset owner community’s motivations, challenges, and perspectives, we introduced our inaugural global survey of 500 asset owners in 2022. Now in its third year, our 2024 Voice of the Asset Owner Survey validates several key assumptions from previous years while also uncovering emerging trends and fresh insights.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.