The Takeaway

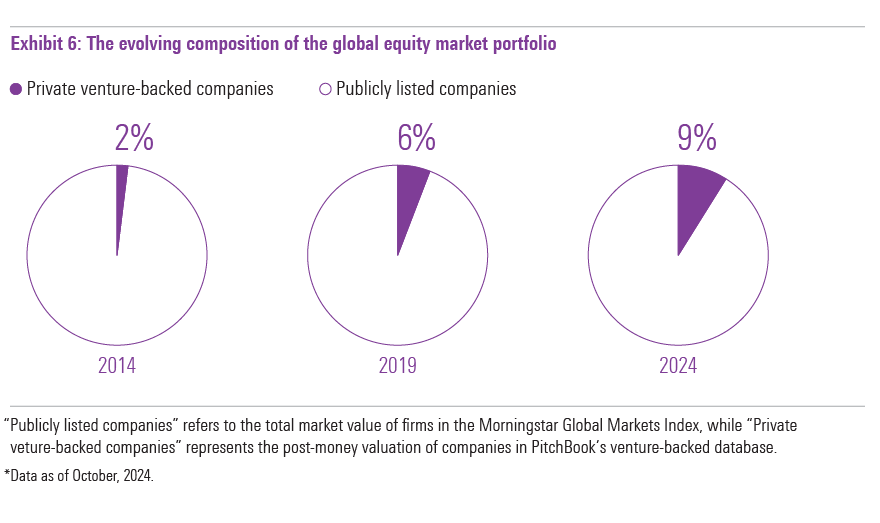

Over the past decade, the venture capital market has grown much faster than its public counterpart. Since 2014, global private-equity assets have grown ninefold, while the public markets have only doubled.

Venture capital, as an asset class, is now more relevant than ever, providing an expanded investment landscape that allows for greater diversification and access to high-growth opportunities.

By including unlisted equity investments in a diversified portfolio, investors can broaden their opportunities and capture a larger share of global value creation.

Venture capital has emerged from the shadows. It accounts for a growing share of the global equity market and has become too large to be overlooked. High-growth venture capital (VC) backed businesses—the subject of this paper, as opposed to traditional private equity (PE) backed companies that are more mature—are engines of global economic growth and value creation. The venture capital market is worth $8.26 trillion, 1 divided almost equally between the United States and the rest of the world.

Some of the most well-known companies of our time, such as ByteDance (parent company of TikTok), SpaceX, OpenAI and SHEIN, a major online retailer based in Singapore, are emblematic of this trend. Like their now-public predecessors Airbnb and Uber, these companies are often market influencers long before they go public. Their impact extends far beyond their respective industries, positioning them as key drivers of global economic growth.

The global market value of private venture-backed companies now surpasses the public markets of every country except the US and China. Global investors, who would never overlook key economies like Germany, Japan, or the United Kingdom in their portfolios, understand the benefits of portfolio diversification. Why, then, would they exclude private equity from their consideration?

With venture capital out of the shadow, public equity markets no longer represent the full scope of the global economy. Investors seeking broad global diversification risk missing out on substantial growth opportunities by waiting for companies to go public.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.